The M&A landscape is ever-evolving, driven by dynamic trends, regulatory shifts, and innovative strategies that shape the future of deal-making. The Fall 2024 issue of The Earnout Magazine, produced by Sadis, provides a comprehensive guide through these complexities, making it an indispensable resource for industry leaders, emerging players, and everyone in between. Sadis, a trusted name in M&A and financial services law, expertly curates each edition, and this fall issue lives up to its legacy of in-depth, actionable insight.

In this edition, Sadis brings together voices from across the M&A ecosystem, addressing topics from navigating emerging sectors and strategic earnouts to understanding the fine print in evolving regulatory landscapes. As the sector contends with a challenging market, regulatory scrutiny, and heightened risk assessment, this issue serves as both a strategic guide and a toolkit.

Key Highlights from the Fall 2024 Issue

-

Emerging Sectors and Strategic Opportunities: With traditional sectors becoming saturated, The Earnout examines how acquirers are looking to capitalize on emerging markets. This section dives into industry trends such as green energy and technology, spotlighting areas poised for exponential growth. These insights can be game-changing for investors seeking to stay ahead of the curve and identify resilient, high-return assets.

-

The Art of the Earnout: One of the standout articles delves into the strategy behind structuring earnouts. As earnouts become more popular in M&A transactions, understanding how to balance risk with reward is crucial. The magazine offers practical advice, including tips on navigating contingencies and aligning incentives to ensure that both buyer and seller interests are met.

-

Regulatory Developments and Their Impact: Sadis continues to keep its audience informed on regulatory changes and potential pitfalls in M&A transactions. This section offers an analysis of the latest regulatory updates and how they affect different sectors, providing readers with a proactive approach to compliance and risk management.

-

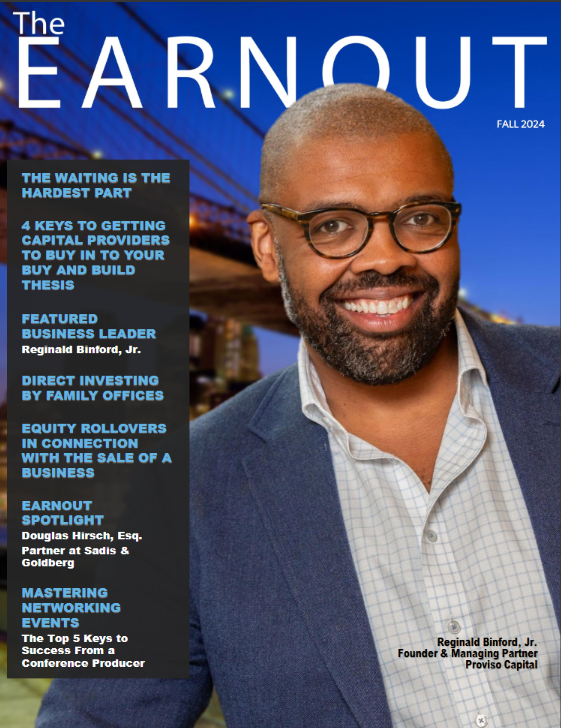

Spotlight on Deal-Maker Insights: The Fall 2024 edition includes exclusive interviews with some of the leading minds in the industry. These seasoned professionals share their experiences and offer insights into what it takes to thrive in today’s competitive landscape. From navigating complex negotiations to fostering strategic partnerships, these perspectives are invaluable for anyone looking to enhance their deal-making capabilities.

-

Maximizing Value Creation: This issue explores actionable strategies for value creation in acquisitions, such as post-merger integration and cost-saving initiatives. By focusing on what happens after the deal is closed, The Earnout reminds its readers that long-term value is often determined by the steps taken post-transaction.

Why The Earnout Magazine is a Must-Read

Sadis’s The Earnout Magazine has established itself as a reliable source of market intelligence, offering practical guidance grounded in real-world scenarios. Whether you’re a dealmaker, investor, or advisor, this magazine brings to the forefront the knowledge needed to navigate complex transactions effectively and strategically. With each edition, Sadis consolidates its commitment to equipping readers with insights that translate directly into actionable strategies.

The Fall 2024 edition of The Earnout Magazine stands out as a critical resource for any professional involved in M&A. In a time when market conditions and regulatory environments are rapidly shifting, staying informed is not just advantageous; it’s essential.

To read the full Fall 2024 edition, visit The Earnout Magazine by Sadis on Issuu.

.png?width=600&height=150&name=logo%20(6).png)